Health Care Reform: Distributing the Surplus

With Supreme Court's ruling handed down its time to politicize the decision. Constitutional platitudes and rights oreinted rhetoric have dominated the political debate, and the economics of health care reform has taken second stage. Many American's are wondering who will benefit most from the favorable decision. Today, Sommer Mathis put out a piece for the Atlantic entitled Where the Uninsured Live which included a map created by Atlantic Senior Editor and Urban Theorist Richard Florida commenting on the current distribution of Health-Care coverage:According to the article, "More than one in five people are uninsured in roughly a dozen states, starting with Texas (27.6 percent), Mississippi (23.5 percent), Florida (22.9 percent), Oklahoma (22.1 percent), California (22.0 percent), and Nevada (21.9 percent)." The punditry and blogosphere have frequently explained political resistance to the Health Act using a host of "Republican" variables. Sommer's reports, "Politics and ideology factor in as well. Conservative states (based both on the percentage of state residents who identify as conservatives (.58) and the percentage of who voted for McCain in 2008 (.60)."

But these people, will also have to pay individual for their universal coverage. Most American's get their health insurance from their employer. According to CNN money, "The cost to cover the typical family of four under an employer plan is expected to top $20,000 on health care this year, up more than 7% from last year, according to early projections by independent actuarial and health care consulting firm Milliman Inc. In 2002, the cost was just $9,235, the firm said."

In an interview with the Constitutional Free Press, Republican Attorney's General Association head called the mandate a tax on the American people, and the Supreme Court agreed, legitimizing the legislation on those Constitutional grounds. The legal profession is already hard at work creating the new interpretation of it's Constitutional impact. For a full treatment see the Post-Decision Health Care Symposium @ SCOTUSblog.

Politics aside, looking at the impact on the insurance market, it seems clear where consumers stand to benefit the most from the implementation of the new regulatory structure. While support for healthcare reform is far from universal, political resistance to AHCA has been concentrated in South and West. Political hostility towards implementing the policy correlates heavily with the coverage map above. As it stands, the mandate benefits those with insurance more those without insurance. If you have insurance, broadening the risk pool lowers theoretically lowers your premiums. When Universal Health Care is implemented with a hybrid, public-private, quasi-tax scheme the health savings generated will fall largely to those already covered.

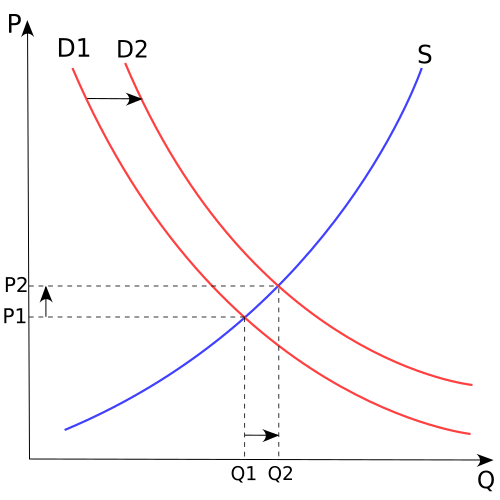

Competition requires exit from the supply side to be free. Neo-classical economics has few models to describe compulsory demand (lack of consumers choice to explain behavior), but the law of supply and demand states that demand will shift outward, and if supply remains tied to its current cost function price will increase.

Health Insurance in America is a $700 billion industry. 60 million American currently do not participate in the market for Health Insurance. The NY Times projects that the new legislation will lower that number to 27 million. That's 33 million new customers signed in 2014. The economics of the mandate suggests it will succeed if the costs savings gets passed to consumers, but if firms see the artificial demand inflation as a way of capturing increased rents, then the biggest winners are likely to be America's Largest Health Insurance Companies.

The Author:

- John Louis

No comments:

Post a Comment